- Published on

Week 1

Overview

Day 1, 18th July

The team met up for the first time! We discussed the problem statement and brainstormed a list of questions to ask our client for our very first client meeting on the 19th July. After coordinating with Team 7B, this was our final list of questions we planned to ask our client.

- Please provide us with an example of a use case/scenario of the application

- How often would you like to update on our progress?

- What is the expected product out of these 2-3 weeks

- Is there any previous projects/work done that we are able to use as reference while working on the project?

- Is there any issues that users encounter while trying to maximise their savings

- How do customers currently decide whether to transfer funds between different accounts or not? What factors influence their decision-making process?

- Are there specific types of bank accounts that users commonly find challenging to work with when it comes to bank transfers?

- How do users currently track and compare interest rates across multiple bank accounts for informed decision-making?

- In your opinion, what aspects of the user interface could be improved to make the process of transferring funds between accounts more streamlined and user-friendly?

- What features or functionalities do you believe would be most beneficial in this application to meet the needs of users effectively?

We can't wait to meet our client the next day!

Day 2, 19th July

The team headed down to the client's campus in the morning for our first meeting! Here is a view from their campus.

The team learnt for the first time that the problem statement arose from the rising cost of living in the UK. The idea of creating a solution to help people deal with the rising costs of living through maximising interest rates is a new concept that existing solutions so we were free to explore ideas to tackle this problem.

We learnt that there were 8 different types of savings accounts (Easy access, fixed rate savings, etc.). One thing that stood out to us was the the banking system in the UK was not as integrated as in Singapore. For example in Singapore, our banking information is all linked together via a government digital identity, called Singpass. However in the UK, the user must go through their respective banks to retrieve their financial details.

The team started brainstorming ideas individually and we decided to come together the next day to discuss our ideas and come to a concensus on the direction of our solution.

Day 3, 20th July

The team came to a concensus on what the main ideas of our solution

- View interest rates and cashbacks of different savings accounts

- Account “hopping” to ensure customer is always using the best savings account.

- Notification when an easy access account that can help the customer save more is available

- Automated opening of account and transfer of funds between accounts

The team started sketching a few potential layouts of the solution to visualise our idea and came up with a list of goals:

- Creating multiple paper prototypes of different pages with buttons

- Split the work amongst the group members so that more prototypes can be thought of in a short span of time

- Maintain a communication pipeline with our client and to update them constantly regarding our progress

- Have a (short) daily meeting to talk about our progress and discuss further on the ideas

We are excited to start working on the project!

Day 4, 21st July

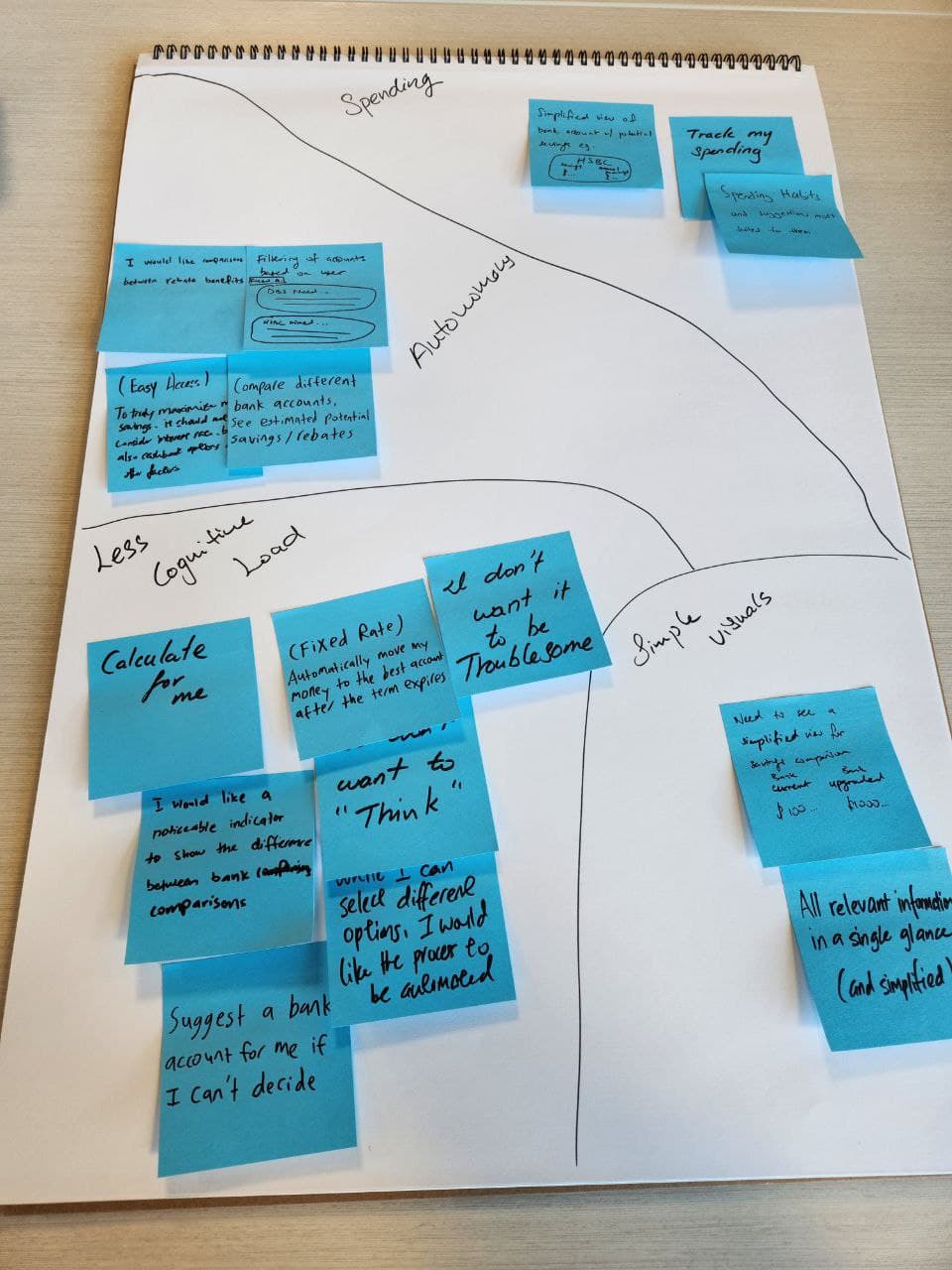

The team started brainstorming a more detailed list of features to be included in the solution. Here is a picture of what it looked like:

The team went into the shoes of the end users and came up with some potential expectations they may have when using the application and experiences they would like to have. These points were taken down when constructing our prototype.

The team looked into a few aspects of the application prototype which were unfinished from yesterday.

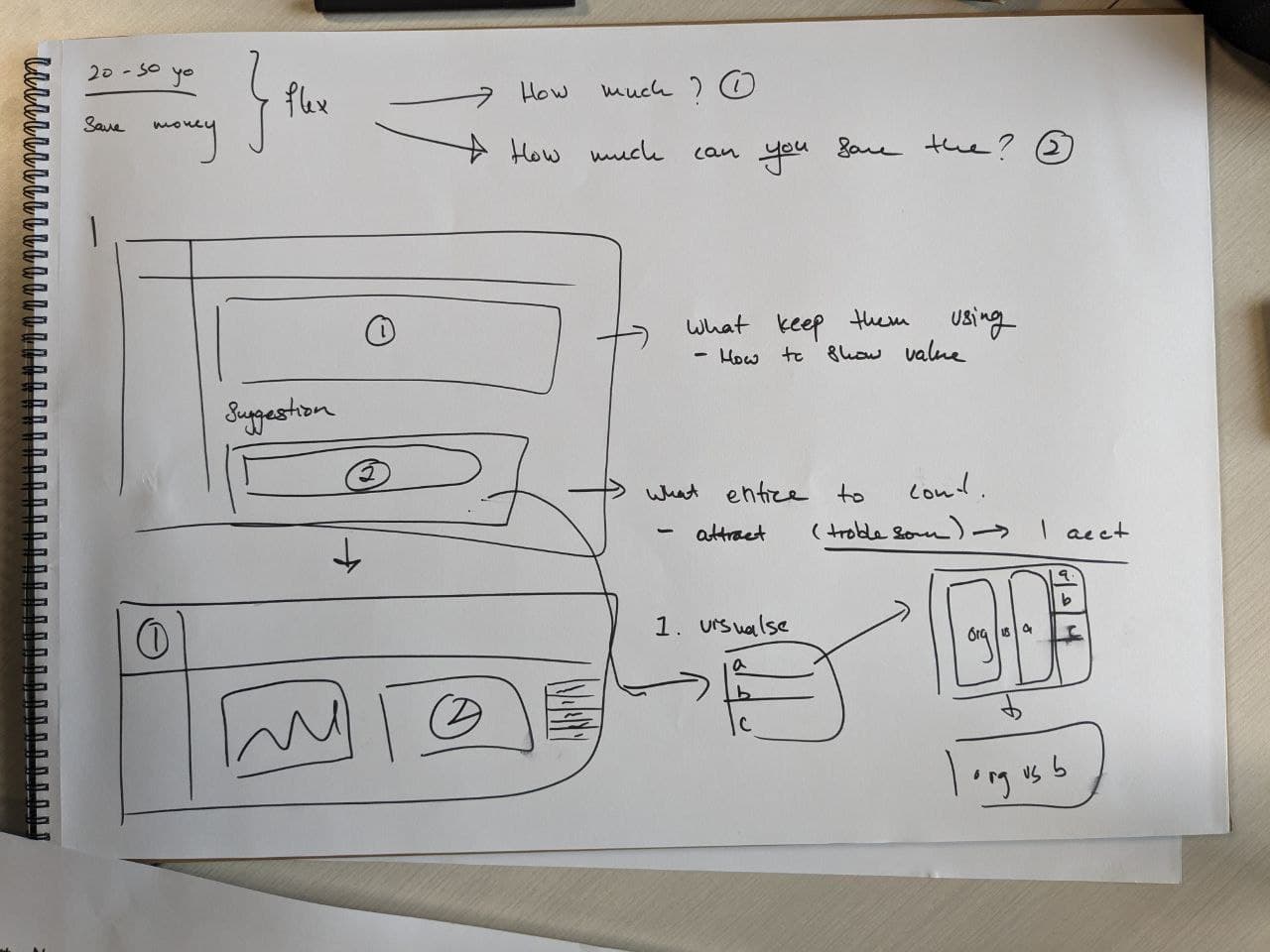

One of these aspects was the prototype layout of the easy access (EA) account feature which was designed to help users save more money through benefits such as cashback and rebates.

Features we felt were necessary to be displayed on the subpage were details of existing EA accounts labelled as (1) represented with the aid of some graphs and details of current account benefits and money saved. There would also be a catalogue of suggested EA accounts users can switch to based on their spending habits, labelled as (2).

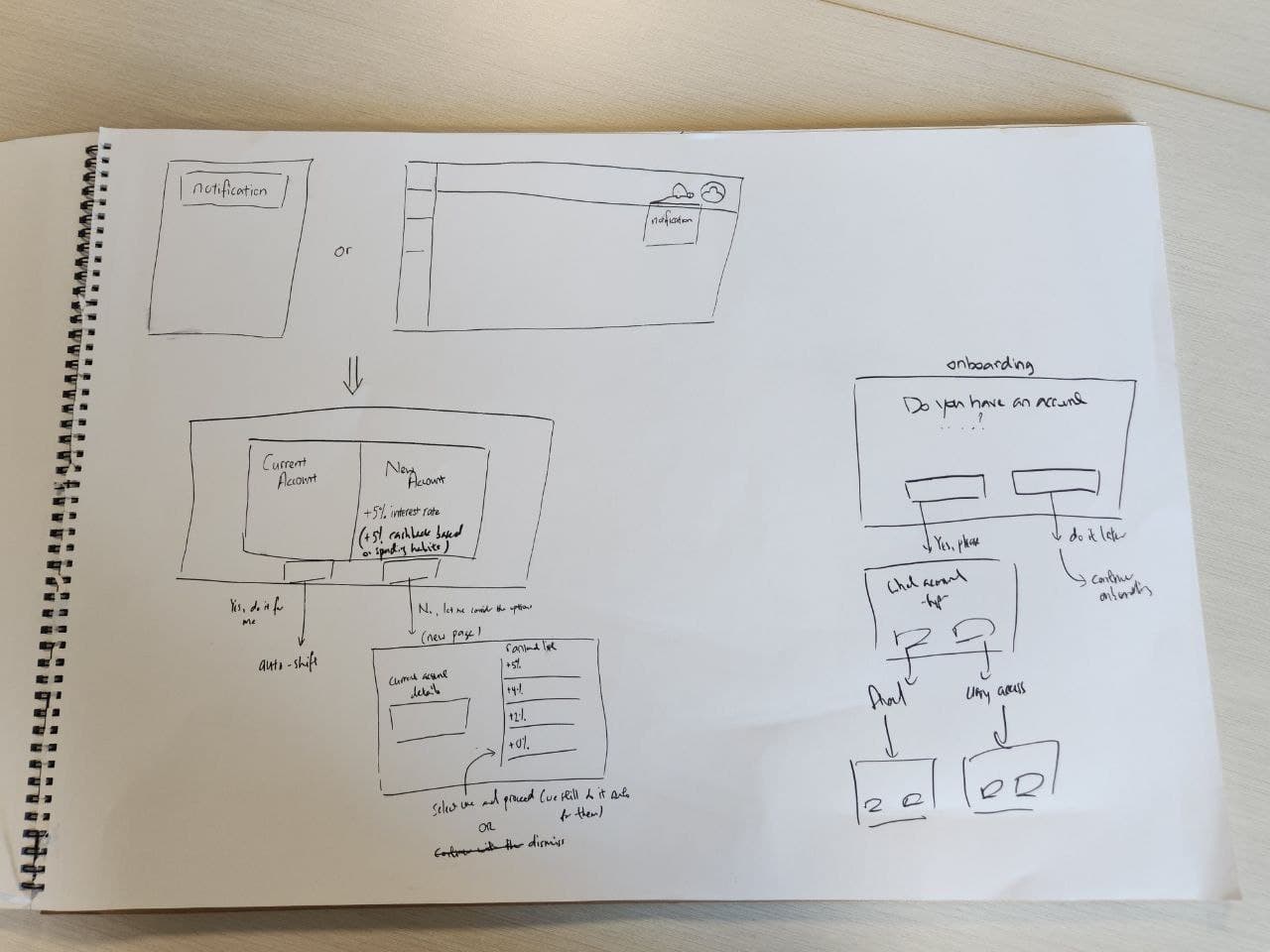

Another aspect looked into was the ideation of a notification system for the application. The purpose of the notification system was to notify users when a better EA/Fixed Rate (FR) account became available to users.

When the notification is clicked on, a popup appears, where benefits of the current and newly suggested account is compared, which then prompts users if they want to switch accounts. This allows the people to know when a better financial outcome is available outside of the application itself, so users are quickly aware of their options.

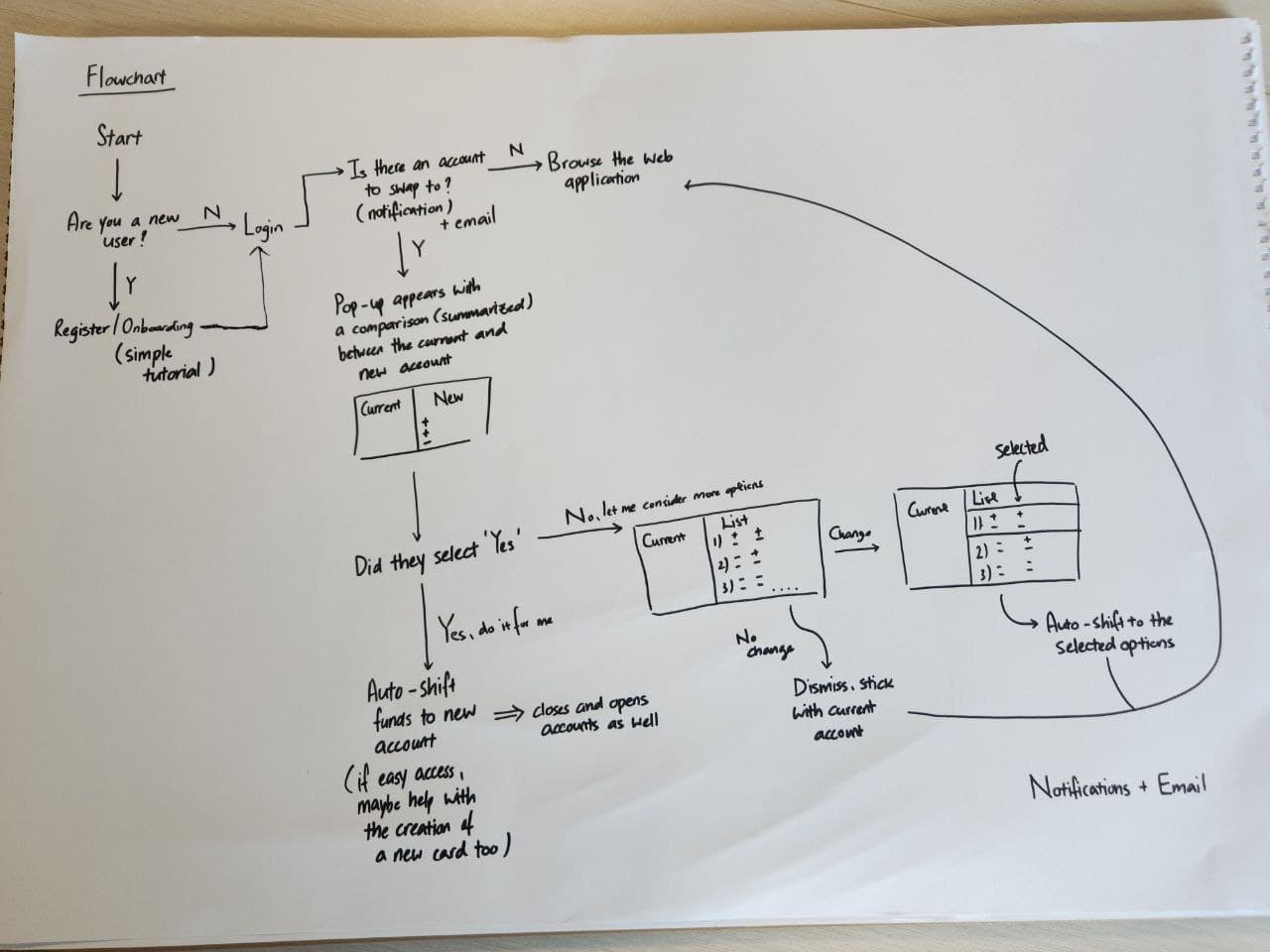

We’ve drawn out a simple flowchart to help illustrate and visualize the workflow of the application from start to finish. This flowchart would also help us better understand how the design and layout of the application should be.

To briefly explain the flowchart, we first check if the user is a new or existing user. If the user is new, they’d have to register an account (and possibly an onboarding process) before logging in. For a user with an existing account, they’d simply need to log in. After logging in, they can browse the web application and look through the dashboard for different graphs on their accounts and spending. Should an opportunity arise for their current account to be swapped with a new account (e.g. better interest rates, etc.), a notification will be shown on the app or on their phone and email should they not have the app open. When clicked, a pop-up will appear which will show a summarized comparison of their current account and the new account with reasons as to why swapping to the new account would be more beneficial.

The team also pitched our idea to other groups. Members of other groups suggested ideas such as when suggested accounts are clicked onto, it will lead to another subpage which will compare the benefits of both accounts, similar to websites like “cpubenchmark.net”, allowing users to make informed decisions on account differences.

We also conducted a simple testing with a potential user of our solution. Based on their comments (aged 24, male), he is enticed to use such an application if it existed as there are no current solutions in Scotland to track cash spending across multiple banks, along with the multiple benefits and rebates across them as well. However, despite that, a downside of the application was that he was not comfortable with automatic bank account creations using important credentials as he prefers to create bank accounts himself manually than to have the systems do it for him. This is an option that our team may have to potentially look into moving forward.